Monday - Thursday

7:30 a.m. - 5:30 p.m.

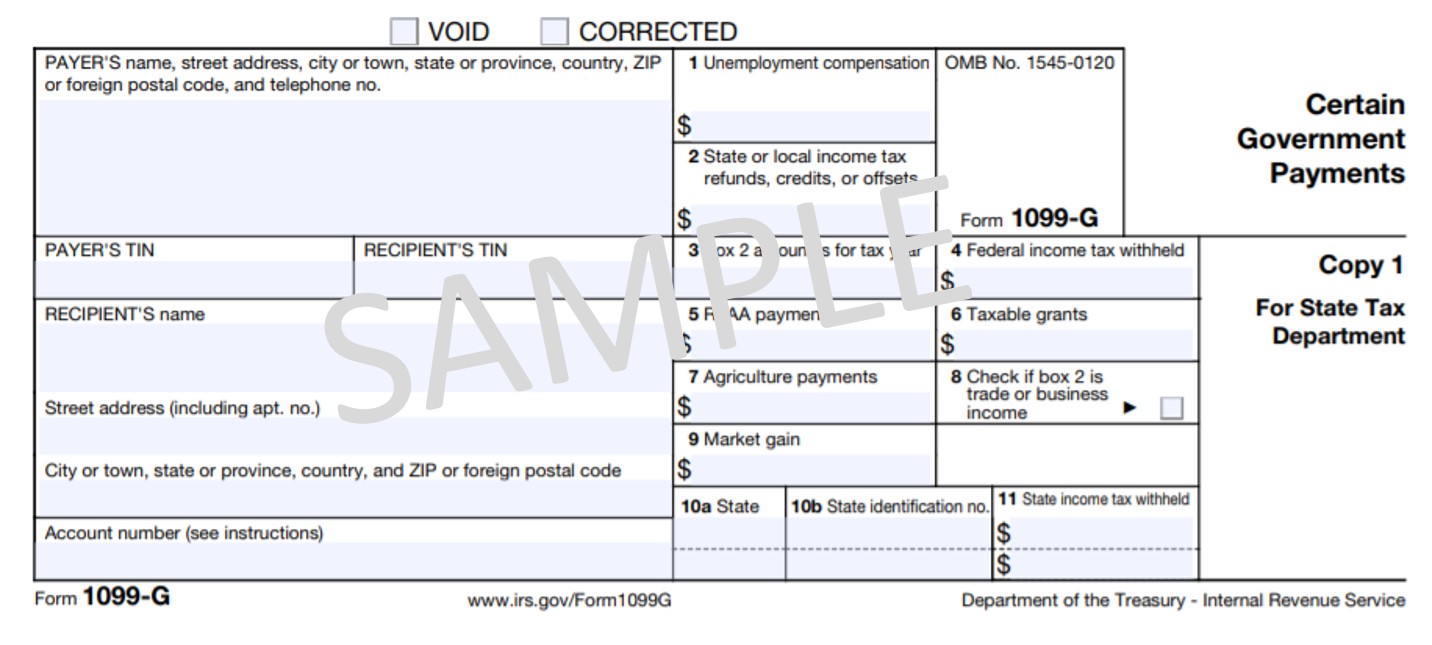

1099 G - Government Payments

You are required to submit a copy of your 1099-G.

Sample 1099-G:

Don't have a copy of your 1099-G?

|

|

| Option | Instructions |

| #1 | Online Request:

|

| #2 | Paper Request:

|

| #3 | In Person Request:

|